Weekly Update – January 5th, 2024-Welcome 2024 – the BOI Reporting Clock is Ticking ⏱️

A BIG Good Morning 🌅 and welcome to 2024🥂🍾🥳🎇, I am happy to repeat the sentiment we have been hearing and repeating over the last few days “Best Wishes For A Happy Healthy New Year for You and Your Friends and Family”; I for one will continue to wish everyone a good day. This week when speaking with my daughter we talked about the holiday meals and visits we had shared with friends and family over the past few days of the 2023 holidays. I shared the “spread” in the food section of the NYT which covered their list of great vegetarian recipes reviewed over the years. I texted her this photo of the article that highlighted Melissa Clark’s Red Lentil Soup …

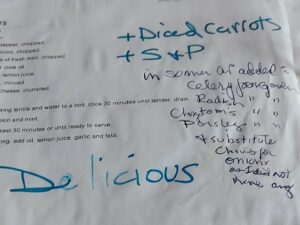

She reminded me that a copy of this recipe also appears in the custom made looseleaf cook book📗 she made for me years ago (I refer to this collection all the time). I checked and sure enough there it was along with stains from prior batches we had made separately and together and my personal comments. The recipe is not only the most reviewed recipe ever, it’s also our family favorite. I started reading through my recipe collection cookbook and found some very funny and personal comments and we laughed and reminisced…

I think my favorite one is “substitute chives for onions as I don’t have any”, oh well.

My weekly blog would not be complete without some favorite shots from this week. I think the winner is the one my friend Bob sent from his vacation home in Sarasota Florida, it almost has me thinking of accepting his offer to come visit…

I think this one from Wednesday morning here in chilly NYC is pretty good too…

I congratulate myself for convincing Raquel to take a walk yesterday afternoon at the end of the day, we bundled up and went about 1 1/2 miles, her cell phone obviously takes great photos…

I hope you shared some great meals over the last few days and your 2024 calendar is filled with plans to get together with friends and family to create some great new memories.

WEEKLY TAKE AWAY

Really listening is critical to proper communication. I often picture Myriam recounting her interaction with her then 3-year-old granddaughter as Lauren recounted a story about school or her brother or something else that was important to her. As she sensed Myriam was not engaged in the conversation, she placed her hands on each of Myriam checks and forced her to look straight into her eyes saying “Chee Chee are you listening, this is very important”. You can picture the encounter. it all comes down to really listening as the key to proper communication. We are all busy and look to cut corners by having a quick chat but we sometimes find that this can cost more in time and angst in the long run. I love the term “temperature check”. The process where you check with person you are speaking with to see if they understand the points, you are making and if they are still listening. So, will endeavor to make sure schedule a one hour zoom or in person meeting, with frequent temperature checks so my 2024 conversations will be meaningful with no or minimal misunderstandings or interpretation.

TAX ISSUES/TAX PLANNING

A New Provision of An Old Law Is Confusing Crypto Investors

The discussion in this recent article in Forbes Digital Assets Newsletters centers around Internal Revenue Code Section 6050I which requires any person who is “engaged in a trade or business” and who, “in the course of such business, receives more than $10,000 in cash in 1 transaction (or 2 or more related transactions)” to file FinCEN Form 8300 to report the transaction.

IRC Section 6050I(d) notes that “cash” includes foreign currency and “certain monetary instruments.” The Infrastructure Investments and Jobs Act of 2021 extended the definition of cash to include digital assets as they are defined in IRC Section 6045(g)(3)(D):

“Except as otherwise provided by the Secretary, the term ‘digital asset’ means any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.” This new provision of the law took effect on January 1, 2024 and has digital asset investors and traders on social media in an uproar.

Beneficial Ownership Information (BOI) Reporting, Now in Effect

For established businesses and those opened prior to January 1st 2024 there is still some time, BUT for 2024 start-ups the clock is ticking for those who are required to report, even with the extra time you only have 90 days from inception to report this information. My recent blog posts (December 8th 2023 and November 10th 2023) have included warnings, updates and reminders about this new requirement to report Beneficial Ownership Information (BOI). Beginning as of January 1, 2024, there are new reporting requirements under the US Corporate Transparency Act (CTA) when new entities are formed. For 2024 ONLY any new entity will have 90 calendar days from formation to come into compliance, provided the entity is not otherwise exempt. For all entities created prior to January 1, 2024, the reporting due date remains January 1st 2025.

At a minimum, the person who is listed as the “incorporator”/ “organizer” in the incorporation/formation documentation will need to be disclosed in the entity’s initial CTA filing. Please see these helpful links to the compliance guides https://www.fincen.gov/boi/small-entity-compliance-guide https://www.fincen.gov/boi

Please note the penalties for errors and omissions are steep: The CTA applies civil and criminal penalties for willfully failing to report or update a reporting company’s BOI and providing false or fraudulent BOI. Civil penalties include a daily $500 fine for a continuing violation, up to a maximum of $10,000. Criminal penalties include up to two years’ imprisonment. The CTA does not contain any provision for non-willful or negligence penalties.

We are looking to crate a list of trusted legal/legal advisors to refer our clients to in order to assure they are incompliance with this requirement. We have already identified 2 third party providers who can prepare and submit the required paperwork on our/their behalf.

ECONOMY

Gas Prices, Where They are Headed this Year

According to recent reports “gasoline prices are expected to tick higher in the coming months on higher travel demand and a more expensive blend of gas. On Wednesday the average gallon of gasoline was sitting at $3.09, down $0.15 from a month ago, according to AAA data Across the US, at least 28 states saw their average dip below $3 per gallon as of Wednesday, compared to just 11 states in mid-November. Yet prices are expected to tick higher as the driving season kicks in. A more expensive summer blend and and extreme heat or hurricanes may also impact prices. “When the dust settles at year’s end, OPIS sees an average annual price of $3.499 per gallon, amounting to the fifth most expensive year ever,” OPIS global head of energy analysis Tom Kloza told Yahoo Finance this week.”

Has America Really Escaped Inflation?

According to this recent article in The Economist “The country’s extraordinary economic vigour keeps the threat alive. Recent data suggest that the economy grew at an annualized pace of 2.5% or so in the final three months of the year, more than twice the median expectation of analysts at the start of the quarter. Although such momentum is welcome, it complicates the outlook as the Federal Reserve contemplates when to start cutting interest rates. America’s strength is broad-based. Investment in manufacturing facilities has soared to record highs, propelled by the Biden administration’s subsidies for electric-vehicle and semiconductor production. Elevated mortgage rates have led to big falls in sales of existing houses, but property developers have responded to the dearth of single-family homes on the market by ramping up building. The government has remained a backstop to growth—albeit a worrying one from the standpoint of long-term fiscal sustainability—with its deficit running at about 7% of GDP, which is virtually unprecedented during peacetime without a recession.”

Federal Reserve Officials Indicated Lower Rates Would Be ‘Appropriate’ By the End of 2024

According to this recent article in Yahoo Finance, ” Federal Reserve officials agreed during their last policy meeting of 2023 that interest rates were likely at their peak, and almost all of them predicted lower rates “would be appropriate by the end of 2024,” according to minutes from that meeting released by the central bank on Wednesday. But there wasn’t a discussion of exactly when those cuts could begin, and participants kept the option of higher rates on the table if inflation were to heat up again. There was also some divergence about exactly how the future could unfold, with several suggesting rates could stay at this peak for “longer than they currently anticipated” and a number of participants warning about the risks to the economy of being restrictive for too long. Where officials on the Federal Open Market Committee were aligned was that the central bank had made clear progress on cooling inflation, citing a six-month reading of so-called “core” inflation as well as signs that demand and supply were coming into better balance.”

GENERAL RESOURCES

IRS resources for stimulus payments: